Advantages and Disadvantages of OTC Crypto Exchanges

There are many different types of OTC markets, each of which has its own set of advantages and disadvantages. The first and most obvious difference between them is the amount of information they display. Listed markets display their bids and offers to the general public and their order books are fully private. Dark pools, on the other hand, offer anonymity. They do not display any information to the general public. However, institutional investors and hedge funds often prefer this type of exchange because of their low fees.

A major drawback of retail cryptocurrency exchanges is limited liquidity. According to CoinMarketCap, the average daily trading volume for cryptocurrencies is approximately $72 billion. Hence, the volume per trade is directly proportional to the liquidity of each platform. In addition, these platforms are unable to trade tokenised assets linked to physical properties. Hence, their liquidity is limited. This is why they are best suited for large investors.

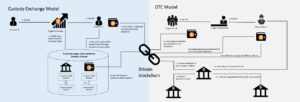

The biggest drawback of OTC trading is the lack of a trusted custody solution. Most of the OTC brokers do not provide a secure custody solution. Hence, many traders use bank transactions and escrow services to minimize operational and settlement risk. To avoid such problems, OTC brokers are now working on providing trusted custodial solutions and risk management systems. As of now, the OTC market is steadily expanding, and many financial insiders are looking into new ways to make crypto deals more secure.

The Advantages and Disadvantages of OTC Crypto Exchanges

In the crypto OTC market, digital dollar stablecoins perform three main functions. They are used as trading capital by professional market participants. They settle within minutes and only cost a few cents. In addition, USDC transactions are tracked in real time, allowing both the buyer and seller to know when the funds have settled. Therefore, storing overnight funds in USDC makes more sense for active traders. In contrast, other digital assets are riskier, thus making them better for hedging.

The OTC market is a popular place for investors to trade cryptocurrencies. Its regulated market allows individuals to buy and sell a wide range of cryptocurrencies. Most crypto-assets are traded over the counter, whereas a typical e-commerce site will only let you buy and sell a few. The otc markets are a great place for institutional investors to store their coins.

Because of the high price volatility, many new and emerging exchanges only offer a small number of cryptocurrency pairs. A large number of these exchanges are only open to institutional investors. Some of the best-known ones are Coinbase and Binance, though their OTC trading is restricted to Coinbase Prime users. While these exchanges are both regulated, they are generally not open to the general public. In addition, they do not allow any trading in cryptocurrencies that are worth less than $20,000.